{{!completeInfo?'请完善个人信息':''}}

精准高效领先的融资对接服务

While Luckin Coffee was making headlines with its joint "Maotai Latté," its co-founder, Charles Lu Zhengyao, had already launched his new coffee brand, which is now making its first appearance in Indonesia.

While Luckin Coffee was making headlines with its joint "Maotai Latté," its co-founder, Charles Lu Zhengyao, had already launched his new coffee brand, which is now making its first appearance in Indonesia. Coincidentally, this is also one of the several overseas markets where "Snow King" SweetXO has entered with its "low-cost advantage." Today, SweetXO has already opened 1500 stores in Indonesia, and you can often spot its prominent brand logo as you wander through the local streets and alleys.

In Indonesia, where the climate is hot all year round, people have a sweet tooth and a preference for chilled beverages. Roadside stalls often sell cold drinks, and in recent years, the beverage sector, led by coffee and milk tea, has found a "second growth" opportunity in the Indonesian market. And this is just a small part of the Indonesian market.

"Those who gain Indonesia gain Southeast Asia" - we often hear this viewpoint from professionals venturing abroad. After members of the August Youth Entrepreneurship Group visited several companies in Indonesia in person, this perception has become more concrete. With a booming economy and friendly policies, the "Time Machine Theory" proposed by Masayoshi Son is also working in Indonesia. The value of this market is being recognized by more and more overseas companies.

Seeing the real Indonesian market.

When Indonesia is connected to international business, several key factors are often mentioned – population dividend, trade-friendly policies, and rapid development. Among the ASEAN countries, Indonesia stands out in terms of population resources, geographical area, and economic strength.

Before delving into Indonesia, it might be helpful to locate the "Emerald Archipelago" Indonesia's position on a world map. In terms of global geography, its location offers unique advantages for trade. Stretching across both the northern and southern hemispheres, Indonesia spans two oceans and two continents, situated along vital international trade routes such as the Malacca Strait, Sunda Strait, and Lombok Strait. Since its initial proposal in 2013 to its implementation, Indonesia has become a crucial node on the "21st Century Maritime Silk Road."

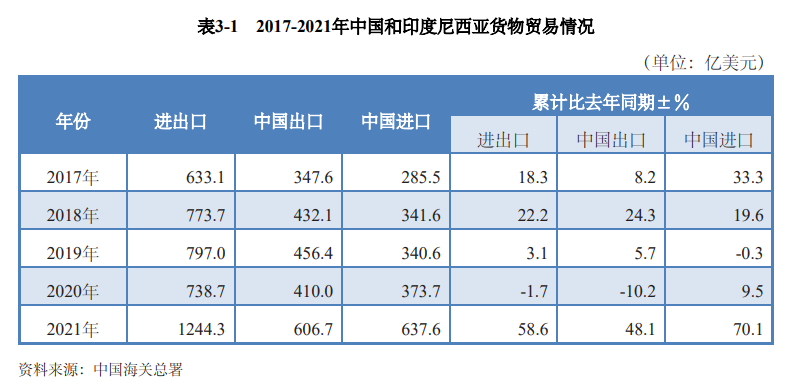

Building upon this foundation, the friendly trade relations between China and Indonesia have strongly driven bilateral trade development. According to statistics from the Chinese Ministry of Commerce, China has maintained its position as Indonesia's largest trading partner for several consecutive years. In 2021, the trade volume between the two countries increased to $124.43 billion, marking a 58.6% growth compared to 2020. Thanks to a series of proactive measures taken by China to expand imports, it has consistently remained Indonesia's largest export destination since 2016.

Looking at it from the perspective of attracting Chinese businesses, Indonesia has also introduced highly appealing incentive policies. On January 2nd of this year, the Regional Comprehensive Economic Partnership (RCEP) officially came into effect. In April, Indonesia formally announced an electric vehicle subsidy policy, reducing the value-added tax on electric vehicles from 11% to 1% for certain enterprises. Against the backdrop of these favorable policies and the efforts of domestic companies to expand overseas, several Chinese brand enterprises and e-commerce platforms, represented by TikTok Shop and Alibaba, are deeply cultivating the Indonesian market.

Turning to population resources and economic development, among the ASEAN member states, Indonesia is the largest economy and the fourth most populous country in the world, with over 262 million people. Looking at the age distribution, Indonesia's population structure is pyramidal, with over 50% of the population being under 30 years old.

The large population brings both new opportunities and challenges to Indonesia. President Joko Widodo announced the launch of the "National Long-Term Development Plan 2025-2045" in a meeting in July this year as part of the "Golden Indonesia Vision" initiative. In this plan, the manufacturing sector is considered a crucial industry for boosting Indonesia's GDP, with the government focusing its support on sectors like textiles and clothing, automotive, and electronics. The increase in the young workforce and reduced labor costs will be favorable factors in driving the development of the manufacturing industry.

Seizing the internet dividend, Indonesia's "new forces" are rapidly expanding

Population dividend not only contributes to Indonesia's economic take-off but also creates an excellent environment for internet development in this country. While vigorously developing physical industries, Indonesia hasn't missed the crucial moment for the growth of the internet sector. Current data shows that Indonesia's internet economy is expected to reach $77 billion in 2022 and is projected to exceed $130 billion by 2025.

Companies that have already established mature operational systems domestically are now heading to Indonesia. What attracts them is the market's "youthful energy" and steadily growing consumption levels.

Today, Xiaomi and OPPO have become prominent smartphone brands in Indonesia. Internet giants like Alibaba, Tencent, and JD.com have also made early investments in Indonesia. In the electric vehicle sector supported by the Indonesian government, Wuling has established factories locally.

Why Indonesia?

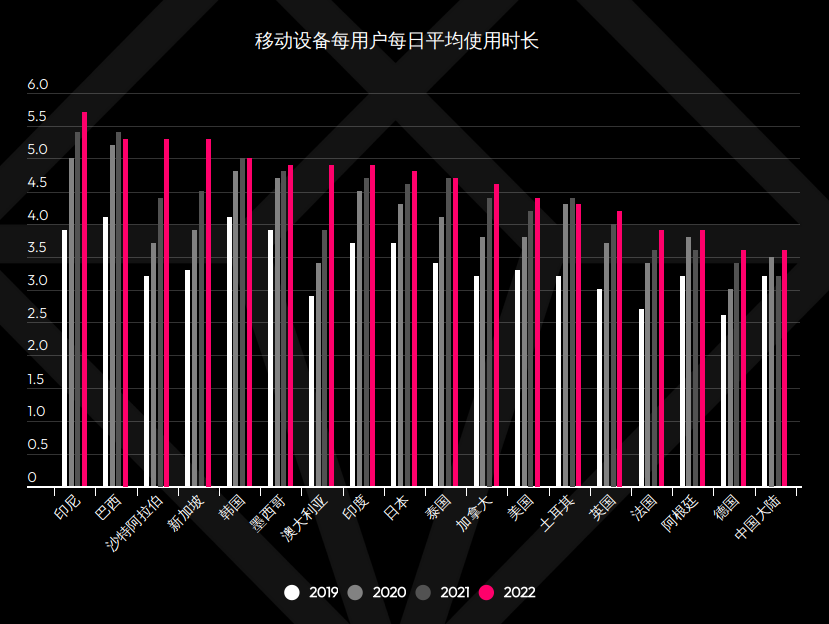

1.In this nation with a youthful population, local people have shown a high level of acceptance for overseas cultures, online entertainment, and new consumer brands. According to statistics, Indonesia had 203 million internet users in 2021, with a penetration rate of 74%. According to data from data.ai, in 2022, Indonesian users spend more than 5 hours a day on mobile apps, and Indonesians are happy to share their opinions on social media. They also enjoy pastimes such as binge-watching and gaming.

2.Indonesians embrace the philosophy of "live in the moment" and possess strong consumption power. According to the Financial Bureau statistics, 35% of Indonesians spend more than 2 million Indonesian rupiahs per month (equivalent to around 1,000 RMB). The Indonesian middle class is a significant consumer group. According to a World Bank report, out of Indonesia's population of 273 million, at least 52 million belong to the middle class in Indonesia.

3.Top internet companies in Indonesia have not yet established significant brand barriers. According to our summary of companies setting sail abroad, we found over 70 top internet companies in Indonesia, with a focus on sectors like communication, gaming, new consumption, and online education. In the industries that outbound-focused companies are interested in, such as gaming, new consumption, entertainment, and fintech, companies like Indofun have emerged as leaders, creating products that resonate with Indonesians.

During our field investigation in Indonesia in August, we discovered several companies that have ventured abroad and established a presence in Indonesia. These include top game developers, early-stage funding institutions in Indonesia, and their leaders. We had in-depth conversations about their past and current experiences entering the Indonesian market.

Now, we plan to share this program with more outbound companies interested in the Indonesian market. From October 17th to October 20th, Yangfan Chuhai will join forces with the 4th Global Internet Industry CEO Summit to launch the "Overseas Enterprise Visiting Delegation" in Jakarta, Indonesia. With representatives from over 10 companies, we will embark on a 4-day, 3-night journey to Jakarta.

End

文章作者:Sailing Global

版权申明:文章来源于Sailing Global。该文观点仅代表作者本人,扬帆出海平台仅提供信息存储空间服务,不代表扬帆出海官方立场。因本文所引起的纠纷和损失扬帆出海均不承担侵权行为的连带责任,如若转载请联系原文作者。 更多资讯关注扬帆出海官网:https://www.yfchuhai.com/

{{likeNum}}

好文章,需要你的鼓励

已关注

已关注

关注

关注

微信号:yfch24

微信号:yfch24

小程序

公众号

社群