{{!completeInfo?'请完善个人信息':''}}

精准高效领先的融资对接服务

"USB charging is very fast, it's a magical cat toy."

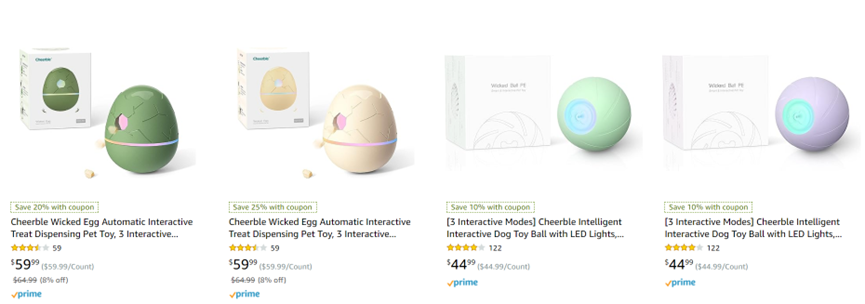

"USB charging is very fast, it's a magical cat toy." On Amazon, underneath a cat toy with a charging rolling ball, user reviews are overwhelmingly positive. This electric ball cat toy, priced at $34.99, has already sold over 900 units and garnered over 2000 user reviews. The brand behind this small electric ball is a Chinese company called Cheerble.

Companies like Cheerble that focus on pet products and their development overseas are not uncommon. The global pet market is worth over $200 billion, and China is the world's second-largest pet economy market. Chinese enterprises have unique advantages in exploring the pet food and supplies market.

Chinese pet product companies have years of experience in going global, and several brands have shown outstanding performance in the overseas competitive landscape. A comprehensive analysis shows that these companies exploring new growth points in the old track, forming a technological barrier advantage by entering niche markets with differentiated products. At the same time, traditional vertical domain companies are also finding new opportunities by venturing into the pet product industry.

Part 1: The global pet supplies market is highly competitive, with emerging markets showing growth opportunities.

CommonThread's data shows that the global pet industry market reached $261 billion in 2022, a year-on-year growth of 12.5%. It is estimated that the global pet industry will maintain a compound annual growth rate of 6.1% from 2022 to 2027, with the global pet market expected to reach $350 billion by 2027.

Looking at regions, the opportunities are concentrated in the three largest markets: the United States, China, and Brazil. The United States, as the world's largest pet economy, holds a market share of 43.7%, followed by China at 8.7%. Recently, Abinpet (the Brazilian Pet Products Industry Association) released data showing that Brazil ranks third in global pet economic market sales, accounting for 4.95% of the global market.

Apart from using regional market size as a basis for entry, if you want to profit from pet owners, it's worth focusing on various subcategories within the pet product and service sector to find out where the real opportunities lie.

One way to gain insights is by following the direction where capital is flowing.

According to statistics from the pet industry, there were 18 financing events in the domestic pet industry in the first half of 2023. The majority of the invested companies are in the pet food sector, followed by pet healthcare and pet services.

It can be seen that pet food, as a high-frequency necessity, accounts for a significant portion of pet owners' spending. In the United States, for example, pet food expenditure reached a staggering $58.1 billion in 2022, a year-on-year increase of 16.2%, representing over 42% of total sales for the year.

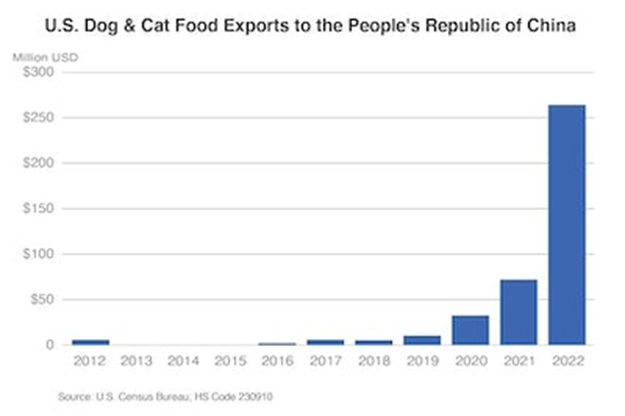

In the past, Chinese companies were not known for producing pet food. Due to manufacturing processes and safety standards, a significant proportion of pet food in the domestic market was imported, while the export ratio was not particularly high.

According to the 2022 U.S. Pet Food Exports report published by the Foreign Agricultural Service (FAS) of the U.S. Department of Agriculture, China's total imports of cat and dog food increased from $10 million in 2012 to $672 million in 2022 (approximately ¥4.85 billion Chinese yuan). FAS investigators noted that China has been the fastest-growing importer of pet food from the United States in the global market over the past decade, without comparison.

The General Administration of Customs of China (GACC) also reported that in the first 11 months of 2022, the total value of pet food exports from the United States to China exceeded $304 million, representing nearly a 200% growth.

Apart from food, the demand for pet supplies, health products, and medications for pets is also continually increasing. According to statistics from the American Pet Products Association, the consumer spending on pet care and pet supplies in the United States reached $35.9 billion in 2022, showing a 4.7% year-on-year growth. The third-largest category in terms of consumer spending is pet health and pharmaceuticals, with a total market size of $31.5 billion, which grew by 5.7% year-on-year.

As the United States is the largest consumer of pet products globally, the consumption habits and trends of its users are essential considerations for Chinese companies looking to enter this market.

With the post-2000s generation becoming a significant part of the mainstream consumer population, it's evident that younger pet owners are treating their pets more like family members. Their demands for pet products are more segmented, covering a wider range of categories. In addition to basic necessities, they seek specialized items for specific scenarios, such as outdoor equipment, travel supplies, and even pet birthday party supplies.

The consumer demand is becoming more segmented, and the growth in consumer spending is quite evident. Data shows that the annual per-pet spending in the United States increased from $238 in 2010 to $343 in 2019, marking a growth of over 44%.

In terms of market opportunities, while traditional established markets are becoming increasingly competitive, there are more blue ocean markets waiting to be explored. Apart from countries like the United States, China, and Brazil, which have large pet populations and high pet consumption, countries such as Russia and Japan have also shown significant growth in demand for pet products. As a result, an increasing number of Chinese companies are setting their sights on international markets, looking to tap into the world of pet owners for business opportunities.

Part 2: New Approaches for Novices to Enter the Overseas Market in the Pet Supplies Industry

Compared to Western countries, Chinese companies have certain advantages in the pet supplies industry. On one hand, they possess a strong manufacturing base, and on the other hand, they leverage technological advancements to cater to new demands. The reduced cost of innovation and exploration both lay the foundation for Chinese companies to gain a competitive edge in the pet supplies market.

In general, Chinese pet supplies companies venturing into the international market exhibit several characteristics. The domestic pet market has reached saturation, resulting in intense competition. However, for new entrants, there are still numerous opportunities in overseas markets. Some companies, with technological expertise and prior international market experience from traditional industries, combine their technical advantages with new market demands, focusing on niche areas. Innovation remains a core strategy, and utilizing technology to create innovative products and explore new market segments is a key focus for these companies.

1.Fierce domestic competition, yet untapped opportunities in overseas markets

Taking Cheerble as an example, this company, established just seven years ago, has achieved remarkable success in international sales. In contrast, Cheerble's domestic Tmall flagship store has less impressive statistics, with only a few thousand followers and a significantly lower number of listed products compared to its presence on Amazon overseas, and its sales figures in the domestic market are dismal.

Cheerble's main focus has been on the international market, and this young company has paved its own path to success.

Cheerble entered the smart pet toy market in 2017, and its product offerings, as seen from its listings on Amazon, cover various categories such as Wicked Ball, Cheerble Board Game, Ice Cream Ball, and more. By January 2020, Cheerble had reached over 100,000 customers with its products.

On Facebook, Cheerble boasts over 37,000 followers, providing a solid foundation for its brand building and marketing efforts.

When it comes to their products, a search for "cat toy ball" on Amazon reveals that Cheerble's cat toy ball isn't priced competitively in terms of value for money. However, their flagship product focuses on smart features. For example, the Cheerble toy ball comes equipped with built-in smart motion sensors and automatic obstacle avoidance capabilities. In their product descriptions, Cheerble emphasizes its dedication to utilizing IoT (Internet of Things) technology to address real-world problems faced by pet parents. The combination of technology and toys enhances interactivity, making it smarter, as described by Cheerble for their cat toy ball, which is said to be "stimulating and challenging."

In Cheerble's product listings on Amazon, their flagship products primarily consist of toys and supplies for cats and dogs. In their brand promotion, Cheerble emphasizes that their products serve as smart companions for pets through interactive designs.

Cheerble has extended this focus on interactive design in both product iterations and product line expansions. For instance, their flagship product, the Wicked Ball, has spawned multiple variations, with the Wicked Ball SE being their fifth product in this line. This design approach not only makes new products better suited to audience needs but also strengthens the brand's professionalism and influence on users during the brand's upgrade process.

2.Entering Highly Specialized Pet Product Niches from Vertical Industries

As the pet industry becomes increasingly humanized, the level of specialization in the pet product market continues to rise. Some companies that have deeply rooted themselves in vertical industries for years have seized this opportunity to diversify into specific pet niches. These niches include pet cleaning products, smart pet products, pet home accessories, pet toys, and more. In these specialized niches, several domestic companies have demonstrated excellent performance.

Feandrea is a company specializing in pet home accessories. Their cat climbing products, in particular, have been highly successful on Amazon. Taking one of their best-selling products as an example, this cat climbing tree is priced at $54, which is considered moderate compared to similar products. It boasts a 4.6 rating on Amazon with over 3,000 user reviews, indicating its high popularity.

Feandrea is a pet product brand founded in 2017, and its products are now sold in 13 countries. Behind Feandrea is a Chinese company called Zhejiang Aopeng Industrial & Trading Co., Ltd. This company initially focused on home accessories and primarily targeted overseas markets. Starting from Germany, they gradually expanded their business to cover multiple European and American countries.

Zhejiang Aopeng Industrial & Trading Co., Ltd., also known as TOUCHE ART, is dedicated to creating a one-stop shopping destination for all home accessories. Currently, their business has expanded to 68 countries and covers multiple product categories, including indoor and outdoor furniture, storage solutions, gardening tools, and pet products.

From the business scope of Zhejiang Aopeng Industrial & Trading Co., Ltd., it's evident that they leverage home product technology as the foundation and extend their product offerings to cater to different user needs in various scenarios, thus expanding into new markets.

According to their financial reports, in 2022, Zhejiang Aopeng Industrial & Trading Co., Ltd. achieved a total revenue of 5.455 billion RMB (approximately 854 million USD) and a net profit attributable to the parent company of 250 million RMB (approximately 39 million USD), marking a 4.29% year-on-year increase. Among their product categories, pet products contributed 7.02% of the total revenue, with a 10% year-on-year growth in 2022.

Compared to similar enterprises, Feandrea's success lies in its ability to leverage the technological and distribution capabilities of Zhejiang Aopeng Industrial & Trading Co., Ltd., combined with market demand for pet products, to conduct product research and development. This not only enabled Zhejiang Aopeng Industrial & Trading Co., Ltd. to establish its presence in the pet product sector but also facilitated the growth of the Feandrea sub-brand. For companies deeply rooted in vertical industries, entering the pet product market is a means to enrich and complement their product portfolio.

3.Innovating Product Categories Using Technology for Differentiated Competition

In contrast to overseas enterprises' deep focus on high-frequency pet essentials like food, one significant strategy for domestic companies entering the pet product market is to innovate their products to achieve differentiation in competition.

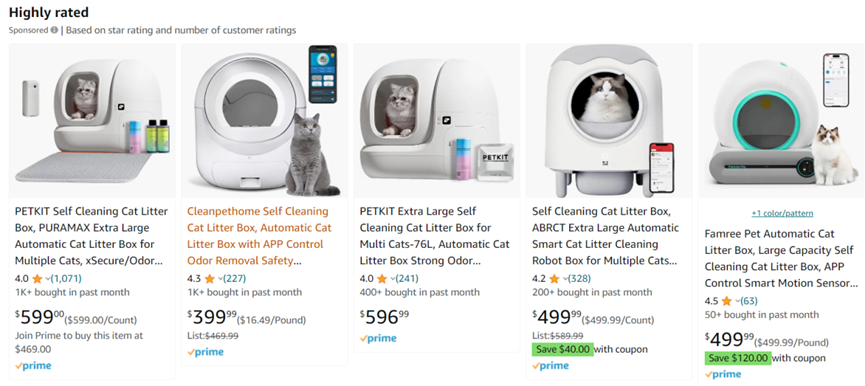

In categories such as smart pet products and cleaning products, Chinese companies rely on their accumulated technological innovations to continuously introduce new products. For example, the automatic cleaning cat litter box sold by the pet tech brand Xiaopei achieves monthly sales of over 1,000 units on Amazon. While Xiaopei's product is priced relatively high at $599, compared to similar products on Amazon that typically range from $100 to $400, its significant feature is its high level of automation, which garners high user recognition based on customer reviews.

The success of companies like Xiaopei, which offers premium-priced but popular products, is closely related to their positioning. Xiaopei was founded in Shanghai, China, in 2013, with a primary focus on high-end smart pet products from the outset. The head of Xiaopei's overseas business once stated that the European and American markets provide ample opportunities for innovative companies, and Chinese companies have a significant advantage in the European and American smart pet product market. The strategic placement of high-end products is one of the most critical opportunities in the European and American pet product market.

In their brand marketing efforts, Xiaopei emphasizes being a "high-tech company." Their product designs, including water dispensers, travel cups, feeders, and smart leashes, prioritize product intelligence and high-quality craftsmanship. Over the course of its 10-year existence, Xiaopei's products have reached over 5 million pet-owning households and have been sold in 40 countries and regions. Capital investment has also been robust, with Xiaopei securing six rounds of funding, accumulating nearly 1 billion RMB (approximately 156 million USD) in total funding. Both capital and consumer favor validate the correctness of the high-end and smart direction. Companies like Xiaopei, which integrate innovation and technology into pet products, rely on their ability to understand consumer demand trends comprehensively. By innovating and creating standout products, they have the potential to educate consumers and achieve rapid growth.

Part 3:Conclusion:

Whether in overseas or domestic markets, it is evident that the pet supplies market still holds many opportunities worth exploring. Analyzing both traditional Chinese pet supplies companies and emerging markets, as well as the current status of companies going global, we can see that the United States remains the most preferred destination for expanding into the pet supplies market. Despite intense competition, the market is vast, and opportunities abound.

For pet supplies companies to outperform in this market, the key is not only to deepen their expertise in their core areas but also to innovate in product selection. It's essential to proactively uncover consumer needs and guide them through product education. By doing so, companies can become industry leaders, focusing on greater specialization and depth within the industry.

· END ·

文章作者:Sailing Global

版权申明:文章来源于Sailing Global。该文观点仅代表作者本人,扬帆出海平台仅提供信息存储空间服务,不代表扬帆出海官方立场。因本文所引起的纠纷和损失扬帆出海均不承担侵权行为的连带责任,如若转载请联系原文作者。 更多资讯关注扬帆出海官网:https://www.yfchuhai.com/

{{likeNum}}

好文章,需要你的鼓励

文章热榜

已关注

已关注

关注

关注

微信号:yfch24

微信号:yfch24

小程序

公众号

社群