{{!completeInfo?'请完善个人信息':''}}

精准高效领先的融资对接服务

In the Catholic faith, prayer is the means through which believers communicate with God.

In the Catholic faith, prayer is the means through which believers communicate with God. It can be praise, supplication, repentance, or simply an expression of one's own or someone else's thoughts or desires.

For people of faith, prayer and the study of religious doctrine are essential daily activities. Therefore, in the era of technology, religious apps that serve as aids have become quite popular and a choice for entrepreneurs. As early as 2008, the first reading app, "Bible," was released, and over the years, this track has continuously seen new challengers.

From 2023 onwards, prayer apps continue to proliferate in app stores. Searching for the keyword "Prayer," I found a total of 304 apps. When narrowing the timeframe to the previous year, we discovered several apps with downloads exceeding one million, and even five million.

In what seems to be a crowded field, why do we continue to witness the story of "latecomers taking the lead"? This is the answer we are seeking today.

Why does there always seem to be new products in the seemingly simple Bible reading category?

A day in the life of a Catholic individual typically involves devout prayers, studying and learning the contents of the Bible, attending Mass on Sundays, and participating in various church activities alongside fellow believers.

In recent times, there has been a shift towards online experiences replacing physical attendance. A study titled "The Current Social Life of Catholic Believers" highlights how modernization has led to diversification in religious practices, with the advent of online Mass activities indicating that religion is becoming more comprehensive and widespread. The younger generation, known as Generation Z, who have grown up with the proliferation of mobile devices, are accustomed to using smartphones for their religious experiences.

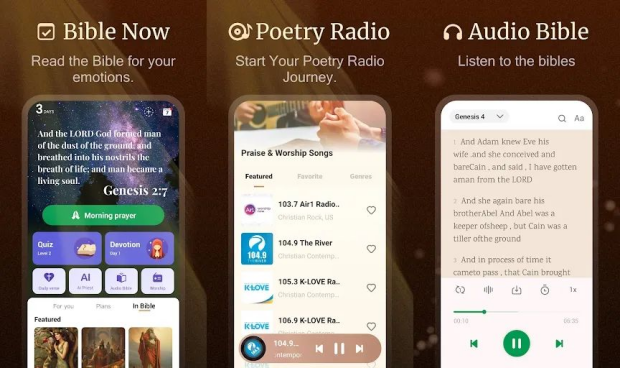

In line with the daily activities of Catholic individuals, the development of religious products in recent years has shown a shift towards a more integrated approach. These products have evolved from being primarily focused on Bible reading, transforming into comprehensive apps that cater to a variety of user needs.

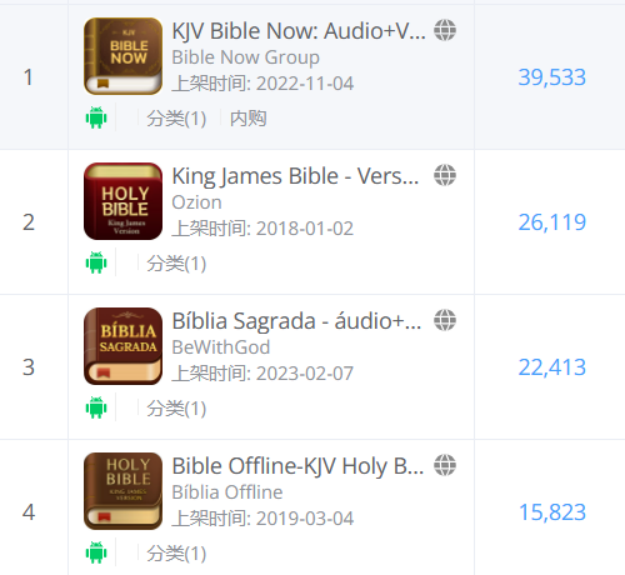

Some of the religious reading apps that are currently being heavily promoted. Source: Broad Data.

Taking the example of the top product in Brazil, "Bíblia Sagrada: off-line+áudio," it goes beyond basic Bible reading functions to consider the practical needs of users in their daily lives. Within the app's features, it includes options for listening to the Bible, gospel radio, content quizzes, daily study plans, morning/evening prayers, and more. These additions enhance the user experience by providing a sense of ritual while catering to a variety of needs.

Taking into account the overall trends in the industry, the changes made to the aforementioned Bible reading app are not isolated cases. After trying out multiple products, we can see that there is a demand for features like meditation to complement Bible study, opportunities to cultivate mental and spiritual well-being, online communities for bringing believers together, and exercise plans designed to address various emotional challenges. These diverse needs are gaining popularity among users.

In comparison, newer and more diverse products are still able to rise to the top in this niche category. While it may seem that the market is predominantly dominated by established leaders, the continuous emergence of new products demonstrates that there is still untapped potential for religious apps to expand into new horizons.

Europe and the Americas have emerged as popular markets for religious apps, but is there a limit to the growth potential in this category?

In the market analysis of Bible reading products, we have identified four countries with a high degree of overlap in the target audience for new product launches: the United States, Brazil, Canada, and Mexico. From a language perspective, many apps are available in English, French, German, Spanish, and Portuguese, indicating that most products are primarily targeting the European, American, and Latin American markets. However, it's worth noting that there is significant religious demand in Southeast Asian markets as well, with the Philippines being one of the Asian countries with the largest Catholic population.

The analysis of typical product launches in the Bible reading category shows that the top three markets are the United States, Brazil, and Canada.

Just recently, the well-known products on the advertising ranking list have also mostly flowed into these markets, quickly gaining ground in emerging Latin American countries. As of the date of this report, the top positions in the free rankings for "Books and Reference" on Brazil's Google Play Store have been occupied by six Bible-focused products.

Based on the product titles and version features, it's evident that current Bible reading products are more grounded and designed to be more localized.

Previously, the head of Great Infinite Business shared with us that there is a significant wealth gap in Brazil and Latin America, where many users may not have sufficient data to support extensive online music streaming. Additionally, the region faces issues with unstable mobile networks. Therefore, in Latin America, there's a preference for products that can operate offline. Considering the limited phone storage available in these areas, Bible reading applications also aim to keep their installation packages as small as possible.

For Bible-related products that require downloading resources for reading and learning, the importance of an offline feature is self-evident. It's noticeable that the top three products in the Brazilian rankings all emphasize the "Offline" attribute in their titles, indirectly increasing the likelihood of user selection.

Looking at the product data, it's clear that religious reading apps have a significant number of monthly active users. This isn't surprising since users need to complete daily reading tasks, and, as a result, these apps tend to have high user engagement. Taking the example of the top product in the Brazilian category, "Bíblia Sagrada: off-line+áudio," it's estimated that this product had a staggering 6.5 million monthly active users in the global market in August, with a monthly download count consistently exceeding 1 million.

The estimated monthly download count for "Bíblia Sagrada: off-line+áudio" is shown in the image sourced from Guangda Data Platform.

However, when it comes to revenue generation, the performance of Bible reading apps is not particularly impressive. In comparison, the revenue sources for Bible apps in the Latin American market do not heavily rely on in-app purchases (IAPs). Some apps may not even offer IAP options and instead generate revenue through IAA (In-App Advertising).

Based on the estimated monthly active users of 6.5 million for the top product with extensive in-app advertising, including splash ads, banner ads, and rewarded ads, coupled with a large user base, the app's revenue potential can be substantial. However, in this increasingly competitive landscape, offering free access to users may still be the primary selling point for these products.

Nonetheless, the religious app market in 2023 is experiencing an unprecedented surge in user acquisition. Taking the product "KJV Bible Now" as an example, according to statistics from the Guangda Data Platform, within a 360-day period since its launch, the app has delivered a total of 410,000 sets of ad materials, with 150,000 unique creative combinations. This level of advertising volume is already considered high within its category.

Looking at the materials that have performed well in product placements, they often use videos to present excerpts from the Bible, accompanied by text that encourages users to install the app, emphasizing daily learning goals such as "study for 20 minutes every day, twice a day with 10-minute sessions." These tactics are designed to attract users to install and experience the app.

Creating Wordle and Playing Coloring Games: Exploring Market Opportunities for Religious Derivative Products

The vast market derived from faith has been consistently underestimated by us. According to the 2022 Catholic population data compiled by the World Church, as of the end of last year, the global Catholic population reached 1.36 billion people, an increase of 15.21 million compared to the previous year.

When researching the companies behind these products, I found that these types of products are usually not developed in isolation. For instance, these companies often have a plethora of products with similar attributes and functions that are pushed worldwide. Additionally, they have expanded into new product categories that integrate with the theme of the Bible, such as word puzzle games centered around biblical vocabulary, famous portraits for relaxation and coloring, and engaging Bible knowledge quizzes, among others.

Bible Trivia Apps

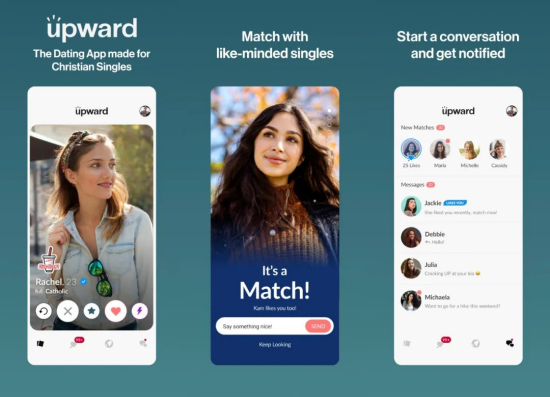

For Catholics, their needs go beyond online entertainment centered around classic scriptures. In terms of spiritual requirements, there is still a vast space waiting to be explored. Taking the example of social dating platforms, apps designed specifically for Catholic individuals have garnered support from some users. For them, these niche apps provide a bridge to find like-minded companions and allies in their faith journey.

Catholic Dating Apps

Under the stable user market and ever-increasing product demand, there is still a long-term growth prospect for creating a series of products centered around religious culture.

·END·

文章作者:Sailing Global

版权申明:文章来源于Sailing Global。该文观点仅代表作者本人,扬帆出海平台仅提供信息存储空间服务,不代表扬帆出海官方立场。因本文所引起的纠纷和损失扬帆出海均不承担侵权行为的连带责任,如若转载请联系原文作者。 更多资讯关注扬帆出海官网:https://www.yfchuhai.com/

{{likeNum}}

好文章,需要你的鼓励

已关注

已关注

关注

关注

微信号:yfch24

微信号:yfch24

小程序

公众号

社群