{{!completeInfo?'请完善个人信息':''}}

精准高效领先的融资对接服务

From 2021 to the present, the trend of integrating 'social+' has become increasingly prominent.

RART 1:Replicating Localization Capability, TopTop Joins the 'Gaming Social Networking' Fray

From 2021 to the present, the trend of integrating 'social+' has become increasingly prominent. Chinese developers have already explored new directions beyond basic dating functions. Today, elements such as voice rooms, live video streaming, games, avatars, and more are common features in social products.

In the Middle Eastern market, where user spending power is strong and there is a large presence of 'Big Rs,' Chinese outbound social products are continuously emerging. Currently, voice rooms have gradually become a 'standard configuration' for Chinese entertainment products venturing into the Middle East. Represented by products like Yalla, Ahlan, Yoho, and others, they have firmly established their position at the forefront of the Middle Eastern social track. Of course, this trend also indicates the potential for voice rooms + social to produce outstanding products in the Middle East.

Starting from the gaming + social direction, when looking at the Middle Eastern market, it seems there is still room for new products to be polished and grow. There are both established products like Yalla and Yalla Ludo, as well as the dark horse product WePlay that emerged in 2022. In a market that has already been well-educated, Middle Eastern users have developed a fondness for the combination of gaming and social interaction, and the achievements of these two leading products over the past year are particularly noteworthy.

Similarly, in 2022, TopTop gradually demonstrated its strong monetization ability. According to data.ai's "2023 Mobile Market Report - Middle East and North Africa," TopTop ranked second in social app revenue in Oman and seventh in Egypt, showing its potential in emerging markets in the Middle East.

Since its launch in September 2018, the TopTop team has taken a full 5 years to refine their product. Looking at the current form of the product, TopTop has made some new changes on top of its localization efforts.

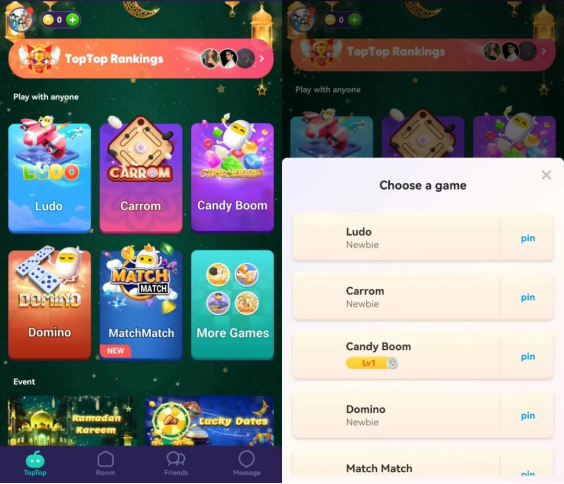

For example, in comparison to typical social+game products popular in the Middle East, TopTop doesn't limit itself to local games commonly played in the Middle East. It not only features popular Middle Eastern games like Ludo and Domino on its main interface but also includes fast-paced games such as Candy Boom, Pictionary, and UNO, suitable for competitive play.

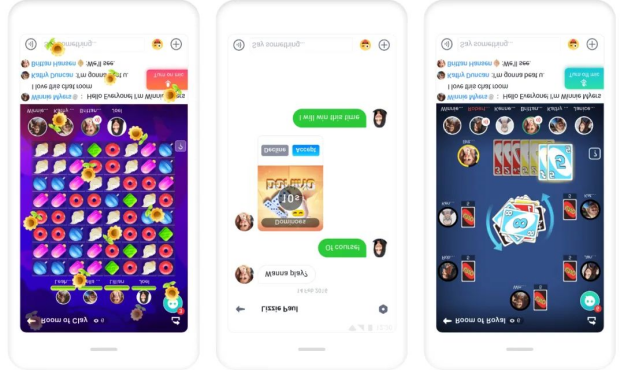

For instance, let's take Candy Boom as an example. It's a classic candy-themed match-three puzzle game. In fact, match-three puzzle games appear more frequently in game social products in the European and American markets, often played in a two-player competitive format. Game social products in these regions also tend to use a layout design with the game at the top and a chat dialogue area at the bottom.

What sets TopTop apart from most game social products in the Middle East is its inclusion of chat dialogue space at the bottom of the game. To enhance the game social experience further, TopTop has designed its match-three gameplay as a 4-player battle mode. Users can select any other player as their target and exchange icons to eliminate candies, with the number of eliminations serving as the attack value. The more eliminations achieved in a single exchange, the higher the attack value. Each player starts with an initial health value, and in each round, they can choose any user to attack. The last player standing wins the game.

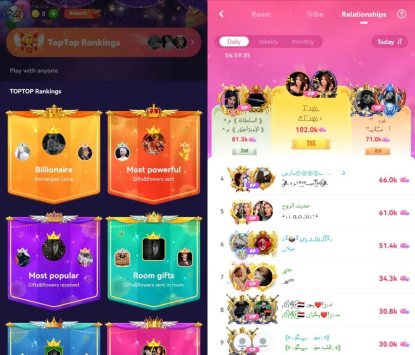

Apart from innovative game category selections and competitive gameplay, TopTop's revenue generation capabilities are also evident in its localized event operations, ranking lists, and the design of its voice room payment model. For example, placing the rankings list prominently at the top of the main page, and setting incentives for rankings such as total gifts sent/received, recharges, room gifts, and intimacy levels (CP), all serve to stimulate competition and spending among high-value users (Big R).

As a product with 5 years of experience, TopTop actually performed well in 2020, although at that time, we didn't know it belonged to Chizi City. In the past year, TopTop has shown a significant upward trend. According to data from Gauda Data, TopTop's total revenue worldwide has maintained steady growth over the past year, and Chizi City specifically mentioned in this quarter's financial report that TopTop achieved a 150% year-on-year revenue increase in the first half of 2023.

PART2:Rebuilding a 10-million-level product: Chizi City's "small goal" in the Middle East

Speaking of TopTop's comeback and push, we cannot ignore the changes in Chizi City's social landscape. In 2023, with more than half of the year gone by, among the Chinese pan-entertainment companies that have already gone public, Chizi City's presence and pressure are growing stronger.

The most immediate sense comes from the financial data disclosed by Chizi City. Its 2023 H1 financial report, released in late August, shows that the company's total revenue reached 1.375 billion RMB, which is roughly on par with the same period last year. Among them, the social business revenue, which shoulders the "heavy burden" of revenue, was 1.243 billion RMB, down 2.1% year-on-year.

Compared to the "steady" revenue levels, Chizi City's profitability in the past year has been particularly outstanding. The financial data shows that its net profit for the period reached 302 million RMB, a year-on-year increase of 96%; the net profit attributable to shareholders was 185 million RMB, a year-on-year increase of 124%. Chizi City Technology stated in the financial report that the improvement in profitability is attributed to the efforts of its team in improving quality and efficiency.

While revenue seems to have entered a "bottleneck period," Chizi City is not worried. On the one hand, Chizi City emphasizes that its revenue changes were mainly due to adjustments in its social ecosystem business in Q1. On the other hand, Chizi City has already outlined its development goals for 2023 earlier this year. In the H1 financial report, Chizi City clearly defined three main directions for this year: 1. Deepening its presence in the Middle East and North Africa markets. 2. Strengthening LGBTQ+ social initiatives. 3. Creating high-quality games.

Why is Chizi City focusing on the MENA region in 2023? During the mid-year financial report meeting in 2023, CEO of Chizi City, Li Ping, mentioned that the Middle East and North Africa (MENA) have a total population of over 400 million people, strong purchasing power, a unified culture and language, and a high demand for social entertainment among the local population. The people in the region have both wealth and leisure time, making it a promising market.

Regarding the social sector that we are most interested in, Chizi City has already established a social product matrix in the MENA region. Among the four social products highlighted in their financial report, MICO, which has already taken global steps, and YOHO, performing well in the Middle East market, are familiar names. However, what is more noteworthy is Chizi City's gaming + social product "TopTop" and the revitalized companion social product "Sugo," which they finally disclosed this year.

In the financial report, Chizi City mentioned that they are confident in creating at least two flagship products with "global monthly revenues exceeding ten million US dollars" in the MENA market. Perhaps, this is the next "small goal" for TopTop and Sugo – to reach a monthly revenue of 10 million.

·END·

文章作者:Sailing Global

版权申明:文章来源于Sailing Global。该文观点仅代表作者本人,扬帆出海平台仅提供信息存储空间服务,不代表扬帆出海官方立场。因本文所引起的纠纷和损失扬帆出海均不承担侵权行为的连带责任,如若转载请联系原文作者。 更多资讯关注扬帆出海官网:https://www.yfchuhai.com/

{{likeNum}}

好文章,需要你的鼓励

已关注

已关注

关注

关注

微信号:yfch24

微信号:yfch24

小程序

公众号

社群