{{!completeInfo?'请完善个人信息':''}}

精准高效领先的融资对接服务

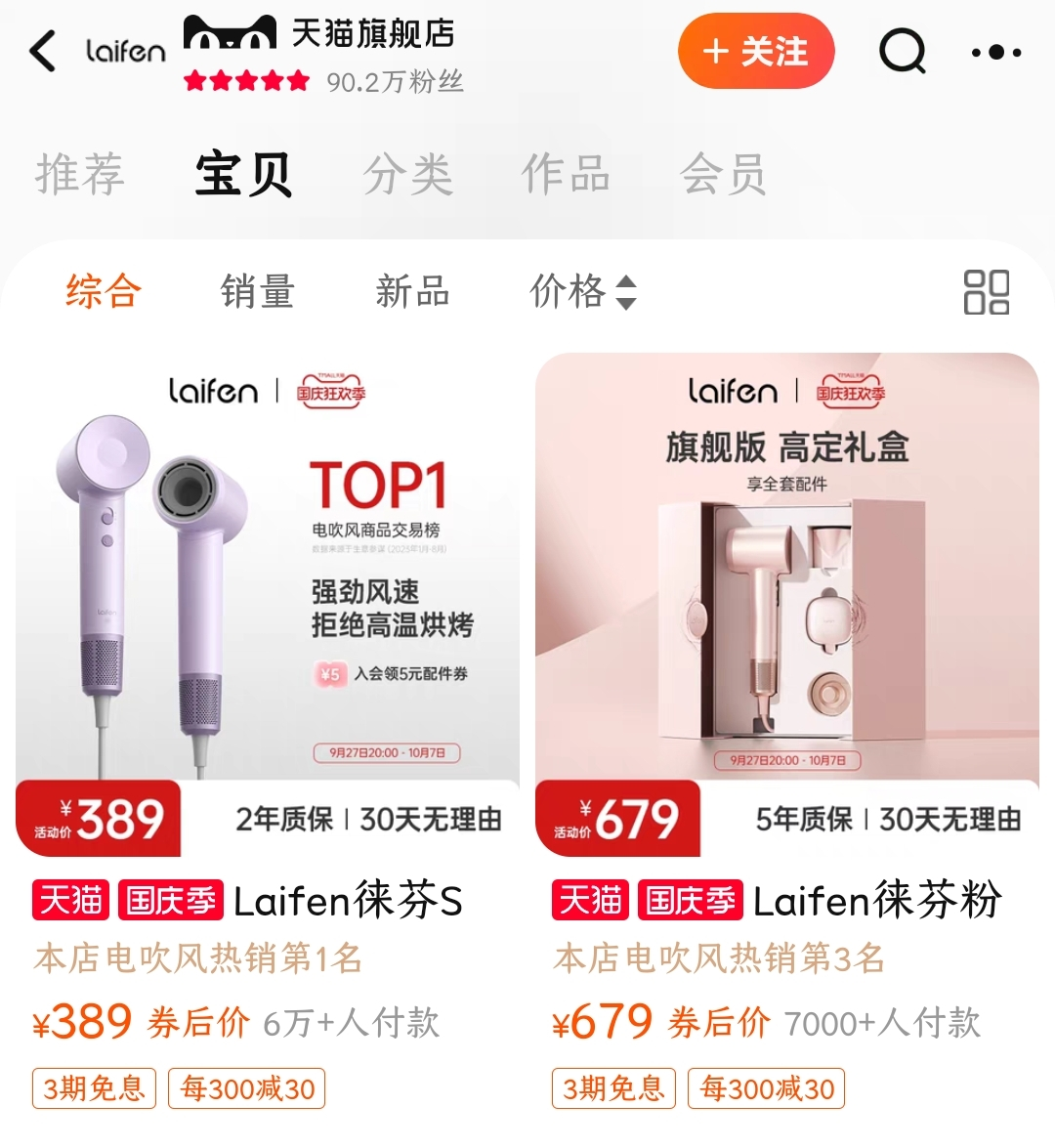

A hairdryer priced at 389 yuan sold 60,000 units, and in the promotional video of a grassroot influencer.

A hairdryer priced at 389 yuan sold 60,000 units, and in the promotional video of a grassroot influencer, it's touted as a "high-quality domestic product replacing well-known brands," claiming that "with a gentle press of the button, the airflow feels like it's worth two to three thousand." Lefan, a hairdryer brand that emerged in 2018, has become a leader among domestic hairdryer brands in just five years.

Not only has Lefan seen a surge in sales in the domestic market, but in 2022, it also achieved impressive results in overseas markets, serving as a vivid example of successful international expansion for Chinese small home appliance companies. China is a major producer of small home appliances, and over the years, many small home appliance companies have ventured into overseas markets. As a newcomer in the international arena, Lefan's success can be attributed to its technological advantages, product quality, and robust content marketing efforts.

In the current wave of the rise of domestic products, more and more Chinese brands are focusing on expanding into international markets. Lefan's success story can provide valuable insights and inspiration for other domestic brands looking to make their mark globally.

Part 1: Lefan's Success: How the Latecomer Outshone Giants with a "Blow"

While it might take others over a decade to accumulate the necessary technical expertise, Lefan managed to achieve success in just two years. In response to skepticism, the founder of Lefan explained their technological success by stating, "We stand on the shoulders of giants, and the functionalities they can achieve are part of publicly available and transparent product roadmaps."

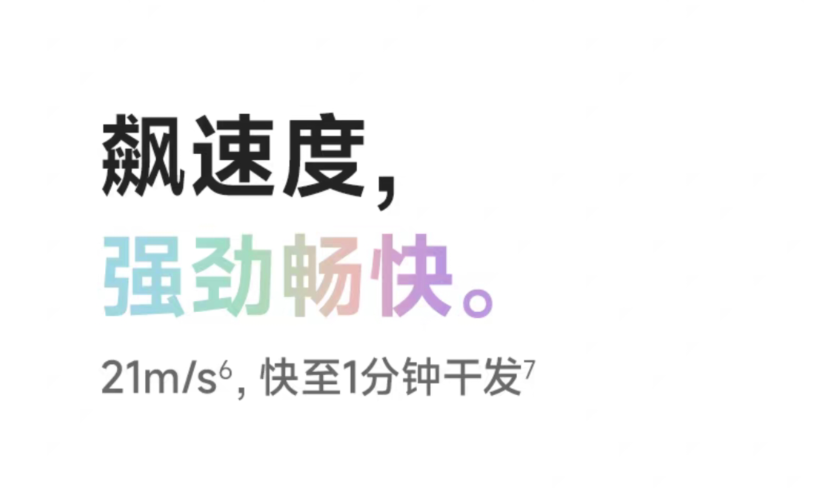

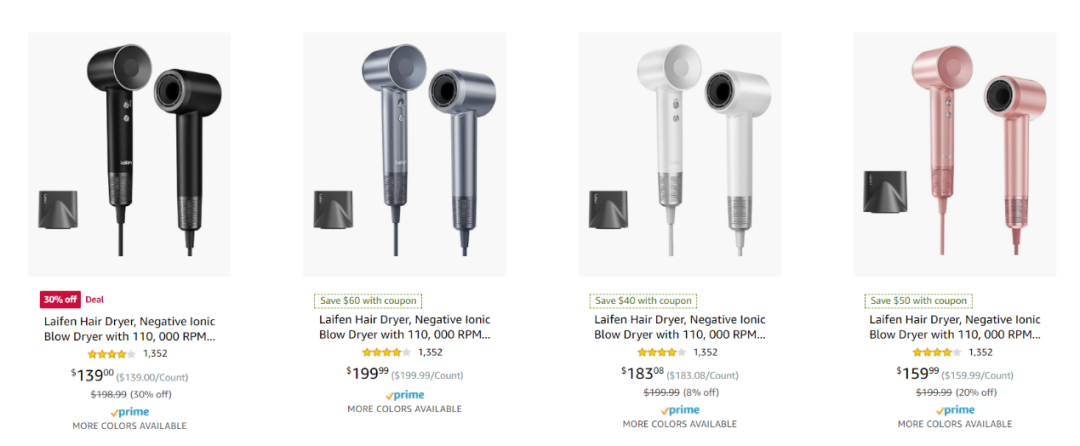

Founded in 2018, Lefan's founder, Ye Hongxin, and his team dedicated two years to break through technological barriers. Ultimately, Lefan's series of hairdryers achieved the same effect as an 110,000 RPM high-speed motor, matching Dyson's rotation speed. This breakthrough marked a significant technological achievement and a crucial competitive edge in the high-speed hairdryer market.

Externally, Ye Hongxin did not provide a detailed explanation of how the team managed to improve the technology in such a short period. However, before founding Lefan, Ye Hongxin's team had a background in aircraft development, so they did have some technological expertise prior to starting the company.

It's worth mentioning that Lefan's products share a high degree of overlap with Dyson's, which raises questions about whether Lefan was simply copying Dyson's designs. Ye Hongxin acknowledges that the team faced challenges in creating differentiation, saying, "We wanted to break through and create differentiation. We also wanted to develop our own structural designs. However, even after we completed our product, we found that (Dyson's) solutions and approach were still the best. We have to admit that Dyson did an outstanding job."

Lefan may be a newcomer compared to Dyson, but it managed to surpass the giant by offering extremely competitive pricing.

On the Tmall platform, one of Lefan's hairdryers priced at 389 yuan sold over 60,000 units. The controversy surrounding Lefan's imitation of Dyson has sparked extensive discussions. Based on user feedback, Lefan's product experience may not match Dyson's, but it still receives praise for its effectiveness.

Ye Hongxin has consistently emphasized the importance of "product strength," stating that "if you can make the product's user experience better, then your product will have differentiation. At that point, doing content marketing becomes much easier, and the overall advertising efficiency will be higher, ultimately leading to conversions."

Building on their technological expertise, Lefan managed to establish its presence in a short amount of time. However, their greatest advantage comes from their marketing efforts.

A rudimentary product launch event that went viral on Bilibili (B站) marked the first step in Lefan's rise to fame. Ye Hongxin mentioned that this event was "critical." They turned the product launch into an educational video about hairdryers and directed it towards Bilibili, a platform with a tech-savvy audience. This garnered significant attention. Simultaneously, Ye Hongxin recognized the enormous traffic on Douyin (TikTok).

By strengthening their content marketing, Lefan's influence continued to grow. Ye Hongxin mentioned the impressive results of their Bilibili video marketing, saying, "Over ten million views on a single video, and in the end, it generated a billion yuan (in GMV)." This has made Lefan increasingly value the power of brand marketing.

Currently, this company with a workforce of 300 has a content team comprising 70 individuals, accounting for nearly a quarter of the entire company.

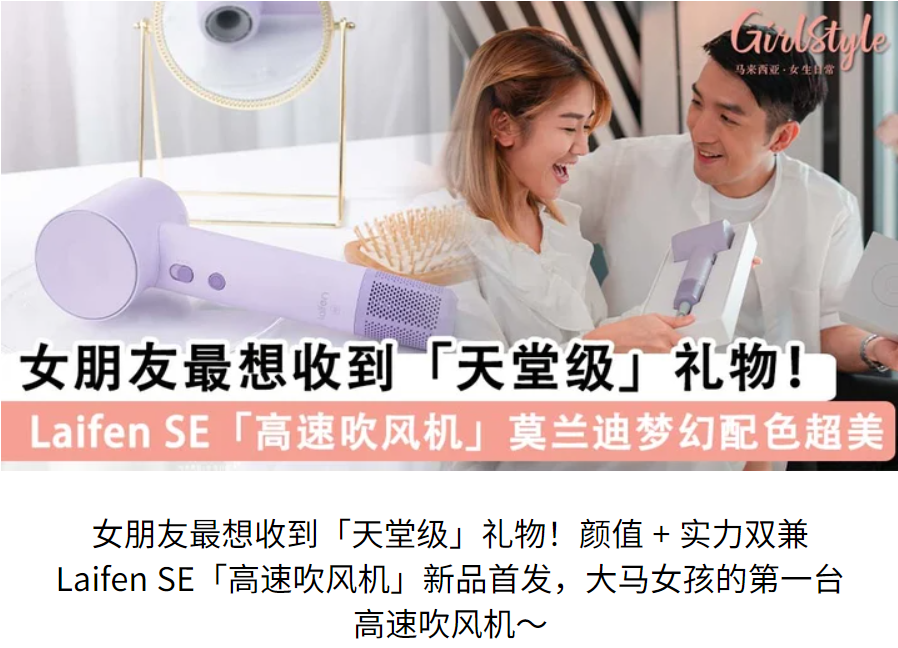

Lefan successfully made its debut with a strategy combining technology and content marketing. If you browse through platforms like Xiaohongshu (Little Red Book) and Douyin (TikTok), you'll notice that many influencers labeled Lefan as a "Dyson alternative," asking, "Is it worth getting a Dyson for ten times the price?" From the feedback of consumers, it seems that Lefan's cost-effectiveness is indeed attractive.

From a consumer psychology perspective, Lefan's marketing tactic taps into a user-friendly approach. While its product might not match Dyson in terms of performance, Lefan's pricing makes up for the performance gap. Furthermore, the "Dyson alternative" label has penetrated consumers' minds. Buying a performance comparable to a $3000 product for $300 is an enticing proposition, even if it's not perfect. The price speaks for itself, and consumers are inclined to think, "Why pay more?"

This consumer psychology aligns perfectly with Ye Hongxin's goals.

When Lefan launched its products, Xiaomi's ecosystem also introduced similar hairdryers, priced at nearly a thousand yuan. However, Lefan's pricing was only half that of its competitors at the time.

Ye Hongxin explained this by saying, "Dyson is not just a hairdryer anymore, but we (Lefan) only have hairdryers. We should compare our price to regular hairdryers." Finding the right positioning was a significant factor in Lefan's successful breakout.

Lefan's success didn't stop at the domestic market. Riding the wave of going global, Lefan set its sights on Southeast Asia, a crucial direction for Chinese small home appliance brands. In recent years, Chinese brands have achieved good results in the overseas market. In foreign markets, Lefan's approach differs somewhat from the domestic market.

Part 2: Seizing Platform Advantages and Leveraging Content Marketing - Lessons from Lefan's Global Expansion

For Chinese companies, venturing into Southeast Asia offers a relatively lower entry barrier, mainly due to the cultural and habitual similarities between Southeast Asian nations and China.

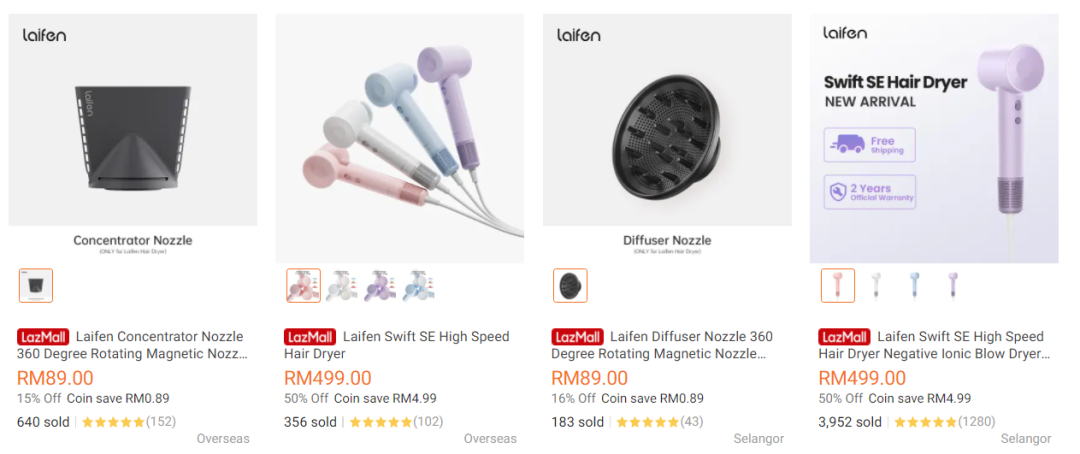

Liofun, a Chinese company, initially chose Southeast Asia as its first overseas market. Lazada, a platform with a significant female consumer base, became its primary stronghold in the Southeast Asian region. "In August 2022, we launched on Lazada, received orders in September, conducted off-platform promotion through Lazada in October, coupled with brand promotions, and in November, our sales saw an explosive increase." Liofun's journey into the international market has been relatively smooth. During the 2022 Singles' Day shopping festival, Liofun's products soared to the top of Lazada's sub-categories for cross-border hair dryers within just one hour of being available.

Liofun places great importance on various major promotional events on Lazada. During the 6.6 SUPER WOW promotion, Liofun experienced an increase of over 200% compared to the birthday promotion held during the same period.

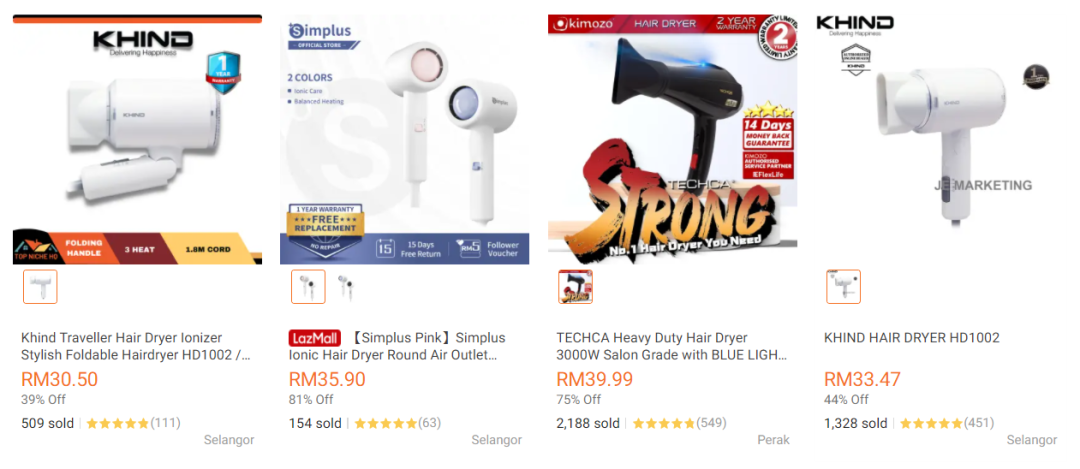

In terms of pricing, Liofun's hair dryers on Lazada are priced at around 600 RMB, while other regular hair dryers are generally priced at a few tens of Malaysian Ringgit, which is equivalent to just a few tens of RMB. When compared, Liofun's pricing for its products after going international is not significantly cheaper than regular hair dryers in China.

Despite not having a pricing advantage, Liofun has achieved sales figures of over a thousand units, which are comparable to regular hair dryers. Moreover, it boasts an impressive rating of 4.9 out of 5, indicating a remarkably high level of user satisfaction.

Beyond Southeast Asia, in April 2022, Liofun commenced sales on Amazon and independent websites in North America. In the North American region, Liofun primarily targets the Chinese-speaking audience. According to Liofun's overseas representative, many local Chinese residents are familiar with or have purchased Liofun products through channels like Taobao in China.

How to approach the overseas market? The author has identified several key factors contributing to Liofun's success.

Firstly, the foundation: Why did Liofun choose Lazada? It's not just because Southeast Asia offers low barriers for cross-border e-commerce. An important reason is that before founding Liofun, Ye Hongxin had been operating a women's clothing e-commerce business on Taobao for many years, amassing a capital of 10 million RMB. Lazada's user demographics closely resemble those of Taobao. Coupled with the habits and characteristics of the Southeast Asian population, it's evident that Ye Hongxin's successful experience on Taobao can be effectively replicated on Lazada. Both platforms cater to a predominantly female audience, and this accumulated knowledge has been instrumental in Liofun's expansion into the Southeast Asian market.

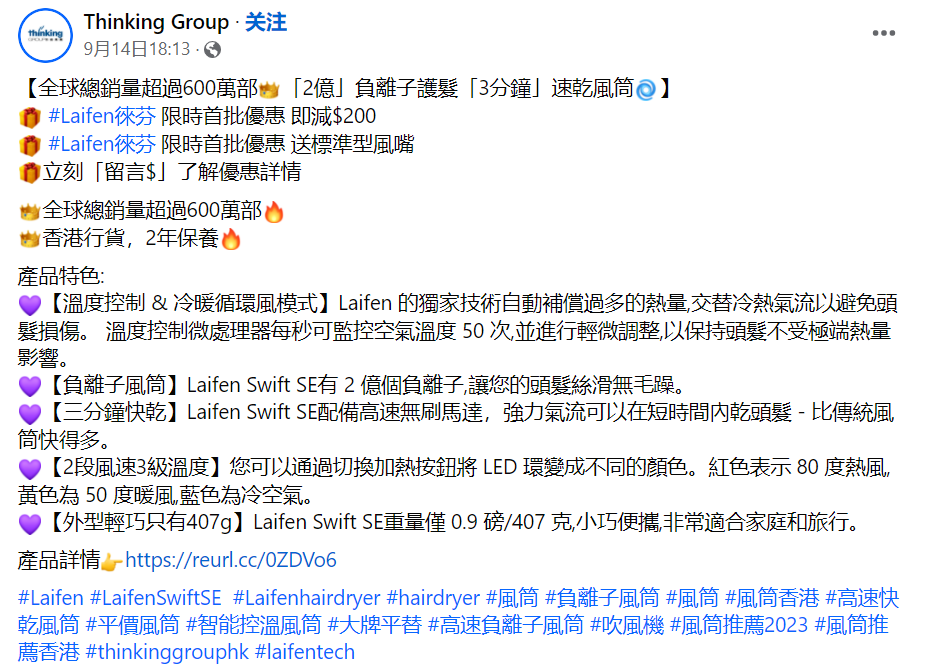

Secondly, marketing: In the domestic market, Liofun tasted the dividends of content marketing through a single video. Leveraging platforms like Douyin (TikTok) and Xiaohongshu (Little Red Book), they achieved widespread dissemination through social media. Influencers recommending Liofun often emphasized the "Dyson alternative" label. Liofun's "wind" effortlessly entered the hearts of domestic users. This "wind" has proven to be effective even when blowing overseas.

On TikTok, Liofun's Singapore account boasts over 540,000 followers. On Facebook, Liofun conducts significant advertising through key opinion leaders (KOLs) like Daily Sharing. In their promotions, bloggers highlight Liofun's selling points of "high-speed drying," combined with tags like "quick-dry," "hair care," and "high aesthetics," primarily targeting the young female market. In practice, replicating the successful marketing experience from the domestic market to overseas has proven to be effective.

The most critical factor remains the product's strength driven by technology. Achieving in 2 years what took giants over a decade in research and development underscores the significance of technological accumulation. Technology forms the foundation for shaping product strength, and it is deeply rooted in the technology itself to drive brand development. This is the most essential and necessary aspect for domestic brands aiming to establish themselves as top-notch alternatives to established brands.

Part 3: What's the Outlook for Chinese Brands Going Global as Alternatives?

The trend of Chinese brands going global, known as "国货出海," has been significant in recent years. According to data compiled and published by Frost & Sullivan, the global small home appliance market grew from $167.3 billion in 2012 to over $216.4 billion in 2021. Within this market, hair dryers, as a crucial category of small home appliances, exceeded $3.5 billion in market size in 2022.

Data from the General Administration of Customs reveals that in 2022, approximately 130.44 million hair dryers were exported from China. Of these, 23.13 million hair dryers were exported to the United States, accounting for about 17.7% of China's total hair dryer exports. This data distribution indicates that Chinese brands like 徕芬 still have significant market opportunities in their chosen global markets, including Southeast Asia and the United States.

In addition to single-product categories like hair dryers, several other product categories have seen positive developments in their global expansion efforts in recent years. For instance, Stone Technology, primarily focused on robot vacuum cleaners, has targeted markets in Europe, the United States, and Southeast Asia, achieving a market revenue of over ¥3.4 billion in 2022. Xiaomi's cost-effective Mi Home product line has driven its entire range of smart home products to international markets, achieving success in countries like Europe and the United States. Brands like Joyoung and Bear Electric Appliances, known for small home appliances, have also seen substantial growth in overseas markets.

Chinese mid-sized and small home appliance brands have established their competitive advantage in terms of cost-effectiveness. To succeed in global markets, they need to combine their strong technological capabilities and competitive pricing with effective marketing strategies. 徕芬's success underscores the importance of content marketing in this regard. Furthermore, focusing on local content development, understanding user needs, and assisting consumers in their psychological journey are essential considerations for Chinese brands seeking to succeed globally in the future.

·END·

文章作者:Sailing Global

版权申明:文章来源于Sailing Global。该文观点仅代表作者本人,扬帆出海平台仅提供信息存储空间服务,不代表扬帆出海官方立场。因本文所引起的纠纷和损失扬帆出海均不承担侵权行为的连带责任,如若转载请联系原文作者。 更多资讯关注扬帆出海官网:https://www.yfchuhai.com/

{{likeNum}}

好文章,需要你的鼓励

已关注

已关注

关注

关注

微信号:yfch24

微信号:yfch24

小程序

公众号

社群